Malawi’s push to expand access to finance to around 95 percent by 2028 will only translate into growth if it is matched with reforms in small business and agriculture productivity, analysts have cautioned. The analysts were commenting on the Malawi National Strategy for Financial Inclusion that runs up to 2028, which seeks to deepen access to credit, digital payments and formal financial services for women, youth, smallholder farmers and micro, small and medium enterprises (MSMEs). The strategy positions finance as a catalyst for resilience, enterprise growth and poverty reduction, but analysts argue that credit alone cannot fix structural weaknesses in the real economy.

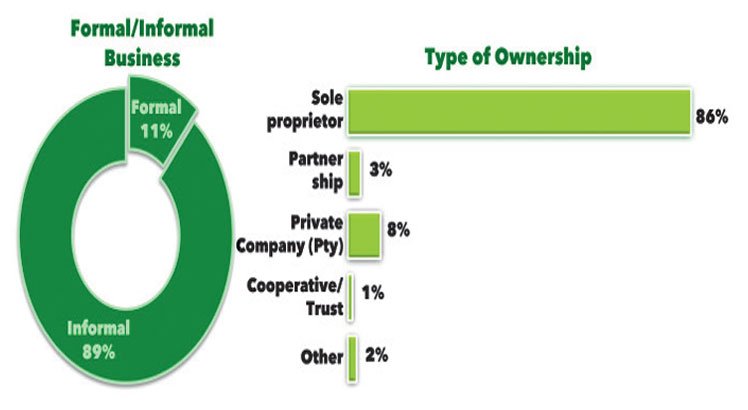

It also acknowledges deep structural constraints, particularly among micro small and medium enterprises and informal agricultural actors and observed that a large proportion of Malawi’s small businesses operate informally, limiting their access to credit, insurance and formal markets. Many small businesses lack verifiable financial records, collateral and credit histories, while high lending rates and stringent documentation requirements further restrict borrowing, according to the strategy. In agriculture, where most rural households derive income, productivity remains low and climate exposure high, the strategy said.

Smallholder farmers also face limited access to quality inputs, irrigation, extension services and structured markets, according to the strategy. This weak productive base reduces repayment capacity and raises lender risk. The strategy warns that without strengthening productivity, formalisation and market linkages, expanded credit access could increase financial vulnerability rather than drive sustainable income growth.

[paywall]

In an interview yesterday, Mwapata Institute research fellow Christone Nyondo said while lack of finance remains a constraint, it is not the primary barrier to higher agricultural output. “Lack of finance is a problem, but farmers also face bigger issues like poor access to improved inputs, bad roads and weak access to extension services and markets. These problems can stop them from growing more crops, even if they get loans,” he said.

Nyondo pointed to a wide yield gap across value chains, with smallholder farmers producing far below potential levels. “In my view, the most important issue for Malawi’s agriculture at the moment is the large yield gap across value chains,” he said, attributing it to inadequate access to quality seed and fertiliser, poor adherence to good agricultural practices and weak extension delivery. Nyondo further warned that expanding credit without irrigation, technology adoption and better market systems risks increasing exposure without raising productivity. “Giving farmers more credit alone may not increase output much,” he said, adding that bundled support combining finance with productivity reforms would be more effective.

[/paywall]

All Zim News – Bringing you the latest news and updates.