South Africa’s passenger car market is revving again, hitting an 11-year quarterly high of 111,697 sales in Q3 2025. With rate cuts, ultra-low vehicle inflation and rising confidence, buyers are swinging back to new cars as Chinese brands accelerate. South Africa’s automotive sector is experiencing a resurgence, the likes of which has not been seen in over a decade.

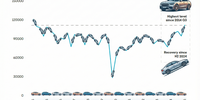

Sales of new passenger car sales experienced notable growth in the third quarter of this year, according to the National Association of Automobile Manufacturers of South Africa (Naamsa). This is reflected in the third edition of TransUnion’s Mobility Insight Report, which paints a picture of a robust turnaround in the sector. Providing a quarterly perspective on South Africa’s automotive landscape, the credit reporting agency found that 111,697 passenger cars were sold in the quarter – the highest quarterly total in more than 11 years.

Year-on-year growth hit the accelerator: up from 14.3% in the last quarter of 2024 to 23.4% in the third quarter of this year. In volume terms, quarterly sales climbed from 94,412 in the second quarter to 111,697 in the third quarter. That’s 17,285 more cars sold in just three months.

Read Full Article on Daily Maverick

[paywall]

This growth is owing to a range of factors. First, the economy showed signs of recovery this year, with GDP growth rising from 0.1% in the first quarter to 0.8% in Q2 – the strongest quarterly performance in two years. Second, the repo rate cut to 6.75% in November 2025 and record-low new-vehicle inflation lowered the entry barriers to buying a new car significantly.

This supportive macroeconomic environment resulted in interesting activity across the automotive industry, according to Ayesha Hatea, director of research and consulting at TransUnion. “As the interest rate eases we find that consumers feel more confident, especially when it comes to these big purchases such as vehicles,” Hatea said. “The other thing that we see is from a vehicle price inflation perspective, the price inflation for vehicles is sitting at 1.5%, which is the lowest inflation rate we’ve had in years.” According to the report, new-vehicle demand rebounded with registrations up 13.7% YoY, while used-vehicle demand slipped 0.5%.

Hatea noted that consumers also receive better finance terms when purchasing new vehicles, adding to the affordability factor. “If you’re financing a new vehicle versus a used vehicle, from a financing house perspective, they do see a new vehicle as lower risk so you are able to get a longer term,” Hatea said. “You’re also able to get a bigger balloon payment on a new car than on a used car.” This is, however, at the discretion of each consumer, as total cost of ownership becomes more expensive with larger balloon payments, Hatea said.

[/paywall]