Infinitesimal intra-Africa trade

As the economy, intra-Africa trade is not growing robustly. Here, instead of using growth percentages, I use growth, or increases and decreases of intra-Africa trade in dollar values. It makes more sense than explaining in growth in percentages. In Figure 1 below, I show Africa’s annual increases or decreases, or if you want, growth of intra-Africa trade expressed in exports. I want to see how much the continent gets from intra-Africa trade each year expressed in dollar values instead of percentages. To do that, I subtract exports of $75,263 of 2017 from $88,175 million of 2018 to get $12,912 for 2018. Then, I subtract $88,175 of 2018 from $80,863 of 2019. For the $8,516 of 2024, I subtract $97,487 of 2023 from $106,003 of 2024 to get $8,516.

My findings are that (i) annual increases of intra-Africa exports are too small. For example, a rise in exports of $14.9 billion in 2021 is really nothing to write home about; (ii) in years 2019 and 2020, a drop in exports of $7.3 and $11.1 billion respectively is, again nothing; and finally, annual growth or increases have not been consistent. In years 2022, 2023 and 2024, exports dropped significantly from 2021. If I showed a graph as I do for GDP per capita later, intra-Africa trade increases and decreases would show largely a contracting trend.

Table 1: Annual increases and decreases of intra-Africa exports in $ millions

Table 1: Annual increase/decrease of Africa’s GDP per capita in US$

I agree with the Policy monitoring and research center (PMRC) when it says, “The implication of a small manufacturing sector for the AfCFTA is that there will be low trade in finished goods which will limit the scope for intra-regional trade.” Intra-Africa trade is skewed in favor of more exports of non-copper or non-traditional products.

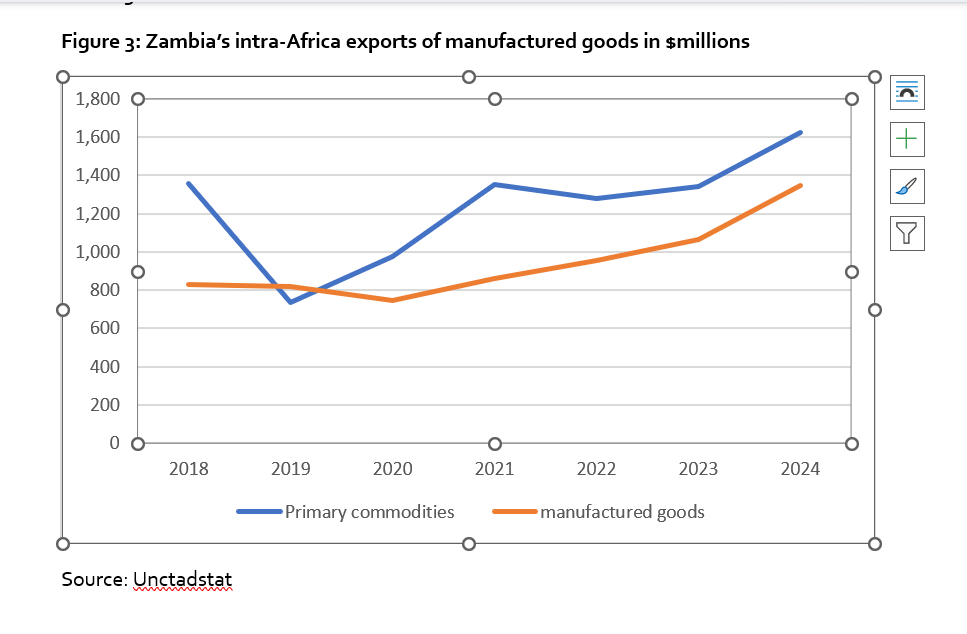

Evidence that Zambia continues to export more primary commodities than manufactured goods is contained in Figure 3 below. The line above the other represents exports of primary commodities and the other, manufactured goods. The challenge is for Zambia’s private sector to match its towering and explosive public rhetoric with reality. Unless a major shift takes place, it will continue to chase shadows.

I conclude by going back to where I began. The problem of Africa’s limited participation in intra-Africa and global is due to Africa’s infinitesimal and slow growth of its economy. Hence, the focus of African nations, individually and at aggregate level, must be to grow economies robustly. Robustly simply means increasing productivity, through development of infrastructure, human capital with cognitive function, shifting mindset, attracting productive investment in manufacturing, or simply learning from emerging Asian nations, in particular Viet Nam, how it succeeded in developing its supply base, to enable it to overtake Africa in global exports of manufactured goods.

Sometimes I wonder what would happen if we arranged a debate, between African and Asian leaders to speak about their economic achievements. Viet Nam leaders will list exports of Electrical machinery, equipment: Machinery including computers: $74.2 billion, Footwear, Furniture, bedding, lighting, signs, prefabricated buildings, Clothing, accessories, Knit or crochet clothing, accessories, Plastics, plastic articles. All these totaled US$499.8 billion worth of exported products around the globe in 2024. What will each African leader, perhaps apart from South Africa list? Self-approbation and celebrating small economic wins.

Read Full Article on Lusaka Times