A year of standout returns is giving way to a more nuanced market rhythm. In 2026, South African investment is moving away from easy wins towards balance and strategic diversification. Local equities gained about 37% in rands, bonds were up 21% and the rand strengthened by more than 12% against the dollar.

Kyle Hulett, head of investments at Sygnia Asset Management, described it as an “amazing year in terms of returns”, with gold the clear standout after rising more than 50%. But in the same breath, Hulett urged restraint. “Volatility is definitely back,” he said, adding that markets are likely to become “a lot more wobbly from here” as 2026 unfolds.

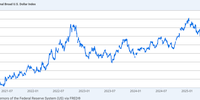

Foord Asset Management portfolio manager Rashaad Tayob believes the broad-based rally across almost all major asset classes, driven by the weaker dollar, is unlikely to repeat. So for all the investor passengers on board for yet another turbulent year: check your safety equipment and prepare your landing gear so that you can be ready for any change in the weather. Neil Shearing, group chief economist at macroeconomic research company Capital Economics, expects the artificial intelligence boom to roll on through 2026, with most of the economic upside accruing to the US.

Read Full Article on Daily Maverick

[paywall]

Morningstar’s 2026Global Outlook Reportestimates that “hyperscalers” like Meta, Amazon and Oracle will spend hundreds of billions of dollars on data centres, with combined capital expenditure in 2026 expected to be four times larger than that of the entire publicly listed US energy sector. This investment wave supports a bullish outlook for growth. Capital Economics expects US GDP to expand by 2.5% in 2026, well ahead of most developed peers. Hulett flagged growing concern about the “huge amounts of debt” hyperscalers are accumulating to fund AI expansion, noting a lack of clarity around the monetisation of these programmes.

[/paywall]